What are the Benefits to Improving Corporate-to-Bank Connectivity?

Often initiated by implementation of shared service centers and rationalization of banking relationships, improving Corporate-to-Bank connectivity generates significant benefits

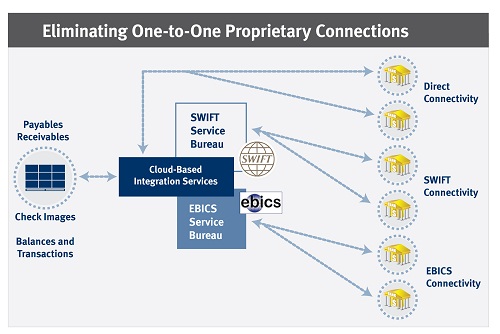

- Achieve enterprise Treasury visibility — Consolidate banking relationships and reduce direct, one-to-one connections allows Treasury to aggregate data more easily, quickly and frequently

- Improve straight-through-processing — Eliminate web portal downloads and manual intervention with centralized bank connectivity

- Optimize cash flow — Reduce cash conversion cycles by leveraging technology that reduces cash conversion cycles, automated cash application and electronic invoicing

- Reduce banking costs and complexity — Fewer banking relationships simplifies fee structures, eliminates redundant services and reduces complexity

- Improve working capital management — Improved flow, and streamlined payments and collections contribute to working capital efficiency

- Monitor global liquidity — Increased visibility of cash supports an in-house bank with netting and pooling of cash, decreasing the need for external funding

- Reduce operational risk — Rationalization of bank accounts improves reconciliation, increases control of bank relationships and enables standardized payment initiation processes

- Enhance regulatory compliance — Reduced manual reconciliation and data aggregation improves audit compliance

Need any help?

One of our Corporate-to-Bank experts would be happy to answer any questions you have.

Simply Ask a C2B expert »