Challenges of Corporate-to-Bank Connectivity

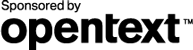

Many organizations transmit data with their banks and other financial counterparties using separate, one-to-one direct connections. There are many different direct connectivity options such as online web portals, dedicated host-to-host connectivity, leased communications lines, EDI networks or fax.

But as the number of dedicated, one-to-one interfaces increases, the challenges of corporate to bank connectivity multiply:

Cost

- Estimated annual cost of $15-35,000 for each interface

- Less staff availability for other projects

Standards Complexity

- Inflexible file format options and lack of ERP integration (SAP, Oracle)

- Limited Internet protocol support for AS2, MQ, HTTPS, SFTP

- Rigid security policies (encryption, firewalls, audits)

Operational Constraints

- Difficult to easily switch or add banking relationships

- Performance and capacity constraints

- Lengthy implementation times

- Limited knowledge of corporate ERP

- Varying capabilities and support processes across different geographic regions

Lack of Integrated Interfaces

- Reconciliation challenges

- Limited visibility to cash and payment status

- Disparate interfaces per bank product line (Cash, FX, Trade Finance, Securities Services )

Need any help?

One of our Corporate-to-Bank experts would be happy to answer any questions you have.

Simply Ask a C2B expert »