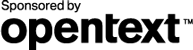

Direct Integration

The direct integration model means Treasury can take advantage of a distinct means of exchanging data directly with each of its partner banks. For some banks, this will mean a host-to-host or machine-to-machine information exchange using an agreed upon data-communications protocol, such as AS2 or HTTPS. For others, an online or mobile bank cash management application may be used. Online banking channels typically provide Treasury with some capacity for file upload and download. In some cases, faxes and/or telephone calls may still be used. Along with differing means of exchanging data, the direct integration model often includes a variety of differing data formats. For statement reporting, BAI2 may be received from one bank while MT940s are received from another. One bank may accept an iDoc and another EDIFACT. This traditional model is usually established as a company grows and expands operations in new markets and geographies.

Pros/Cons

This is an effective model. Data is exchanged with banking partners and treasury decisions and instructions are carried out. However, this models works at a cost. Resources are needed to operate and maintain each individual channel. As regulatory requirements change, new transaction options become available and new services are used. Treasury must oversee accompanying changes to the information security and encryption of their data, as well as changes in formats – even change to a different format. These efforts, combined with the need to apply changes to bank channels on an individual basis, means some portion of available technology resources are dedicated to the tactical work of daily operations, maintenance, and upgrades, and are not available, or not as available as they otherwise would be for more strategic projects.

The direct integration model typically results in a higher TCO than other models as the company leverages more and more banking partners. This is due to the resource allocations noted previously, along with the resources needed to integrate these banking information flows into the company’s financial applications. As a result, the direct integration model is most effective where there are relatively few banking partners. The integration cloud, consisting of data transmission and transformation services, is effectively insourced.

Need any help?

One of our Corporate-to-Bank experts would be happy to answer any questions you have.

Simply Ask a C2B expert »