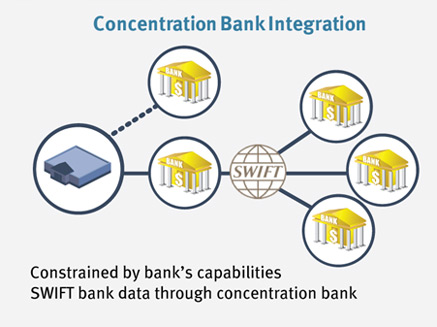

Concentration Bank Integration

This model uses a single, lead bank to concentrate data flows from secondary banks into Treasury. The concentration bank forwards payment instructions and collects status information and balance reporting data from the company’s “other” banks and delivers this data to the company. The integration cloud is shifted to the concentration bank.

There is typically a significant implementation lead time to implement this model. The concentration bank must negotiate secure interfaces (often proprietary in nature) and support arrangements with each of the company’s other banks on behalf of the client. In addition, the concentration bank may need to prioritize and build new bank interfaces.

Pros/Cons

The concentration bank model has the advantage of using a single channel for corporate connectivity, resulting in reduced development costs. However, Treasury is then fully dependent on a single bank for routing and distribution. The relationship with your concentration bank must be a solid, long-term one. There can be minor or even severe integration challenges (both technologically and operationally) between the concentration and non-concentration banks. Lower development costs do not necessarily result in any overall cost savings as the connectivity fees of the non-concentration banks are being replaced with increased fees from the concentration bank.

Need any help?

One of our Corporate-to-Bank experts would be happy to answer any questions you have.

Simply Ask a C2B expert »