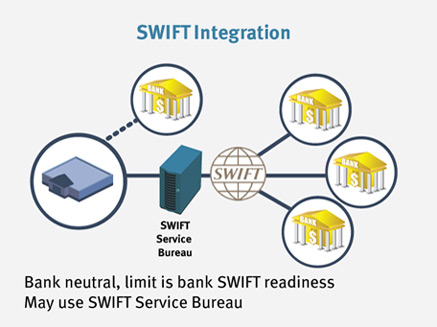

SWIFT Integration

With this model, Treasury employs the SWIFT network to exchange standard messages and data with its banking partners, as well as using standard formats for those messages. Integration becomes less about individual bank interactions and more about data integration to internal financial systems. The SWIFT integration model shifts the cloud to the SWIFT Service Bureau.

With more than 10,000 members, SWIFT can be viewed as a dedicated financial services cloud. Offering both standardized messaging (how data is exchanged) and message formatting (structure of the messages exchanged), SWIFT has registered more than 900 corporate organizations since 2003. These organizations represent 30% of the Fortune Global 500 (source: SWIFT Corporate Forum 2011). SWIFT organizations no longer represent only the largest global companies. Although 29% have an annual turnover of more than €10 billion and 24% have turnover between €1 and €10 billion, more than 47% of the organizations using SWIFT have a turnover of less than €1billion.

Pros/Cons

The essential argument for SWIFT is that standardization offers cost and efficiency gains that outweigh the required initial investment to convert to SWIFT, as well as ongoing TCO advantages when compared with the Direct Model. SWIFT, however, does not (yet) have a message format or standard for every financial transaction. Domestic payment formats such as US ACH or UK BACS do not have a corresponding SWIFT MT or MX message format.

There is still great diversity between banking partners on their ability, and in some cases willingness, to leverage SWIFT as a channel for Corporate Treasury. Finally, the technology requirements to leverage the SWIFT network can be daunting if attempted in-house, and therefore the largest percentage of corporations connect to SWIFT using an indirect means such as a SWIFT Service Bureau.

Need any help?

One of our Corporate-to-Bank experts would be happy to answer any questions you have.

Simply Ask a C2B expert »